Overcoming Barriers

Gimmonix empowers travel companies to do better, together. Interactions between systems, partners and their teams are full of challenges: disparate tech stacks, fragmented content, siloed data and lack of standards continue to pose barriers for effective interactions and mutual growth.

We help companies overcome these barriers.

Discover howYou’re in Good Company

Laser focused on your growth

Gimmonix offers a unique technology blend, focused on making every interaction between you and your partners easy and effective. Built and optimized for scale for over a decade, we’ve helped startups scale and modernize their tech stack.

Speak the same language

Fragmented content and lack of standards make it hard for systems to understand each other. This results in inventory going underutilized or even worse, arising issues. We make sure that all the content you source or distribute is structured, unified and normalized.

Connect at the speed of light

Integrations, certifications, multiple API structures and schemas, along with lengthy certification processes slow down growth and at times bring it to a halt. We provide solutions that allow you to connect with your supply and distribution partners quickly, seamlessly and effectively.

Get rid of margin losses

Systems with broken interconnections are hurting your business. We ensure that you will receive profit from every successful offer at lower processing costs.

Free up your resources

Your team shouldn’t be forced to drown in repetitive tasks and manual efforts to deal with an ever increasing amount of data, inventory and rate changes. We can help put the grunt work on autopilot.

Discover How We Help

Travel Companies Grow

Whether only starting or grossing billions a year, we deliver a suite of solutions aimed at solving some of the most challenging problems facing hotel supply and distribution today.

TRAVOLUTIONARY

TRAVOLUTIONARY

If you need access to dozens of hotel suppliers, our aggregated API provides connectivity to hundreds of hotel providers, with built in mapping and data normalization processes, and an extensive revenue management layer to control and optimize product display and pricing. Natively cloud based, it scales with you.

Learn More

MAPPING.WORKS

MAPPING.WORKS

If you need to unify and normalize hotel inventory data from multiple sources, our hotel mapping solution can automatically normalize any hotel inventory dataset regardless of the source. Available via web app as well as API, you will have full visibility into everything that was or wasn’t mapped and why.

Learn More

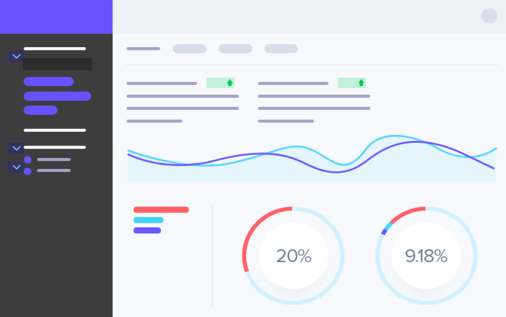

BI.WORKS

BI.WORKS

If you want to gain real insights and not just data, our business intelligence solution provides in-depth pricing insights and hotel inventory analytics, along with technical performance analysis, that will help you stay one step ahead of your competitors.

Learn More

ROOM.WORKS

ROOM.WORKS

If you want hotel room content that converts, our room mapping solution can receive, process and normalize any room information from any source for any hotel in the world and provide back a structured and consistent result matching the way the hotel sells its own rooms.

Learn More

What Our Clients Say

3 Reasons to partner with Gimmonix

Gimmonix empowers you to:

- Save time and resources

- Optimize performance

- Avoid risks to profitability